Fiduciary retirement planning in Scottsdale—powered by a team of professionals.

Design your retirement with a consultative, fiduciary team in North Scottsdale. We build tax-smart income plans and custom portfolios (no mutual funds), coordinate estate & tax considerations with in-office and partner professionals, and custody accounts at Charles Schwab.

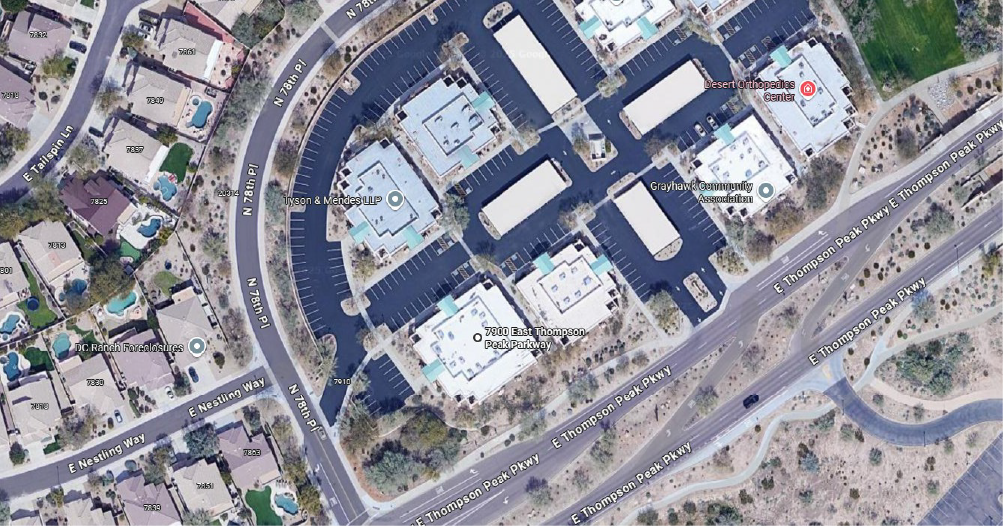

Scottsdale, AZ 85255

Office Features

- Free surface parking

- Ground-floor suite (easy access)

- Wheelchair accessible

- Quiet conference room available

- Near DC Ranch & Grayhawk

- Easy access from Loop 101

Independent RIA · Custody at Charles Schwab · Heard daily on 1100 KFNX

Visiting our Scottsdale office

We're in North Scottsdale near DC Ranch and Grayhawk, just off Loop 101 on Thompson Peak Pkwy. Easy parking on site; accessible entrance available.

Who we serve in Scottsdale & nearby

Pre-retirees (50–60), new retirees, and retirees 70+ with $100k+ investable assets—plus business owners and former owners with more complex planning needs. Meet by phone/video or at our Scottsdale office.

What we do

Retirement Income Planning

Tax-aware withdrawal sequencing and cash-flow mapping

Learn More ›Custom Portfolio Management

Individual stocks & ETFs. Our strategy avoids mutual funds to save you money.

Learn More ›Insurance & Risk Management

Right-sized life insurance and long-term care strategies—modeled into your retirement plan.

Learn More ›Estate & Legacy Coordination

In-office estate-planning attorney (separate legal fees if engaged)

Learn More ›Planning and Tax Coordination

With CPA partners for complex issues (their fees separate)

Learn More ›Our process

Intro & Fit

Clarify goals, timeline, and what success looks like.

Plan & Design

A Monte Carlo is used to stress test your plan & map out tax-aware withdrawals.

Implement & Review

Scheduled reviews and updates to your plan as life changes.

What you pay

- Advisory (AUM) fee for ongoing planning and portfolio management

- ETF expense ratios (we avoid mutual funds, sales loads, and 12b-1 fees)

- Separate professional fees only if you engage an attorney/CPA for document drafting or tax prep

Frequently Asked Questions

How is my money protected at Charles Schwab?

Schwab is a member of SIPC; if SIPC limits are ever exhausted, Schwab maintains excess SIPC coverage (aggregate limits apply). Market losses aren't covered.

Do you meet in-person and virtually?

Yes—Scottsdale office visits or phone/video appointments.

What's your minimum asset level?

Generally $100,000+ in investable assets to implement diversification and planning depth effectively.

Do you use mutual funds?

No. We build portfolios with individual stocks & ETFs. Clients pay our advisory fee and the underlying ETF expense ratios.

Do you coordinate with attorneys & CPAs?

Yes—general planning coordination is included. If you engage them for legal documents or tax preparation, their fees are separate.

Ready to talk?

A 20-minute call is all it takes to see how we can help coordinate your retirement plan.