2026 Edition

2026 EditionRMD & Tax Basics

Understand what counts as an RMD, key dates, and how withdrawals fit your retirement plan.

Get the GuideDownload practical guides to plan income, withdrawals, Medicare/Social Security timing, and estate details. Each guide includes a one-page checklist and next-step prompts you can use right away.

These materials are educational; they're not legal, tax, or investment advice.

2026 Edition

2026 EditionUnderstand what counts as an RMD, key dates, and how withdrawals fit your retirement plan.

Get the Guide 2026 Edition

2026 EditionCompare "now vs. FRA vs. 70," coordinate spousal/survivor options, and see cash-flow trade-offs.

Get the Guide Checklist

ChecklistIEP/SEP/GEP windows, IRMAA awareness, and enrollment to-dos—organized step-by-step.

Get the Checklist Planner

PlannerA month-by-month checklist for the year before retirement (accounts, income, healthcare, estate).

Get the Planner Cheat Sheet

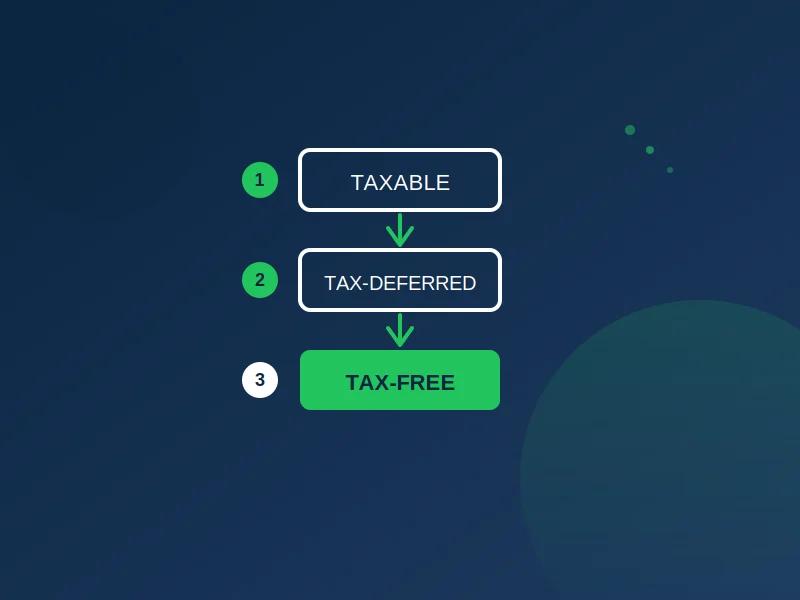

Cheat SheetA simple framework for coordinating taxable → tax-deferred → tax-free, plus exceptions to test.

Get the Cheat Sheet Checklist

ChecklistAlign titling and beneficiaries with your wishes; what to store in your secure digital vault.

Get the ChecklistClick Get the guide → quick form (name, email, city)

After submit: guide downloads instantly, and we email a copy

You can unsubscribe anytime; no obligation to book a meeting

No. These guides are open to anyone who wants help planning retirement decisions.

We may send follow-up emails with related checklists. You choose if you want to schedule a call—there's no pressure.

No. They're educational resources. For legal and tax advice, please consult your attorney or CPA.

Yes—mention it in the download form's notes field and we'll email you options for receiving a printed version.

Our guides are a great starting point. If you'd like personalized guidance, schedule a 20-minute introductory call.

Or call us directly: (480) 597-1743

All meetings use a clear agenda—you'll know what to expect and what to bring.

Instant download + email copy

Your info is secure. We never share or sell your data.